working capital turnover ratio interpretation

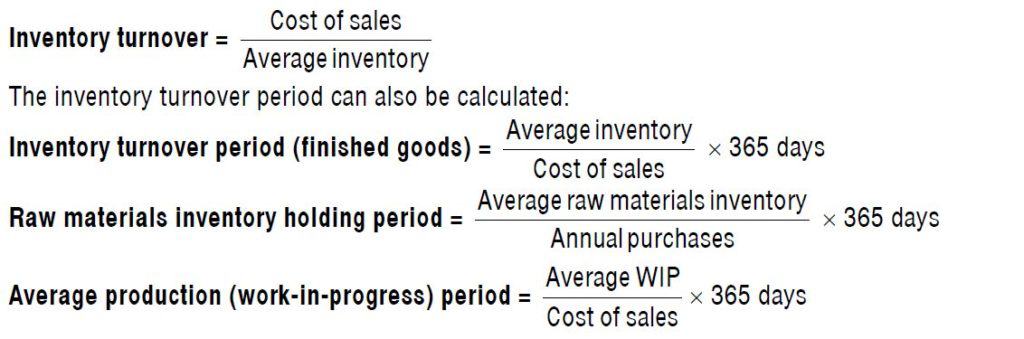

Working capital Turnover ratio Net Sales Working Capital. Low inventory to working capital turnover ratio implies that the company is not generating sales sufficient enough from the working capital available.

What Is The Working Capital Turnover Ratio And How Is It Calculated

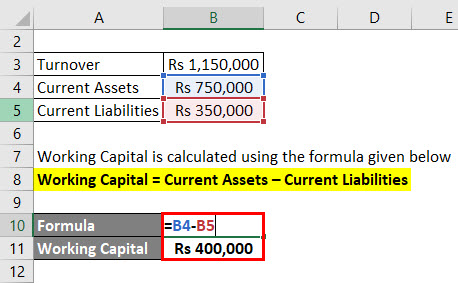

And Working capital Current assets Current Liabilities.

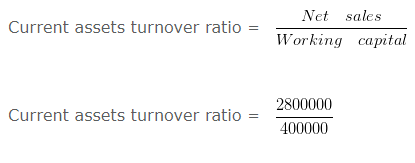

. Collapse of the company may be. 240000 140000 280000 1000002. The reciprocal of the ratio will become 025 that is the reciprocal of 41 is 14.

It indicates that for. Working Capital turnover ratio Formula example and. It means each dollar invested in.

The working capital turnover ratio shows the companys ability to pay its current liabilities with its current assets. The working capital turnover is a ratio to quantify the proportion of net sales to working capital. The formula for the ratio is net sales over current assets minus current.

It means each dollar invested in working capital has contributed 214 towards total sales revenue. Notwithstanding this also varies from industry to industry and theres no standard ratio for all companies. Meanwhile the average working capital is calculated by adding up the working capital of the current period with the number in the previous period divided by 2.

An extremely high working capital turnover ratio can indicate that a company does not have enough capital to support its sales growth. The working capital turnover ratio of Exide company is 214. The working capital turnover ratio of Exide company is 214.

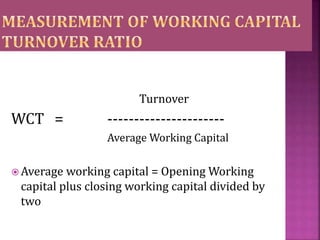

Average Working Capital equals working capital at the start of a period plus working capital at the end of the. Average working capital. The Formula for the Working Capital Turnover Ratio is.

Working Capital Turnover Ratio Revenue Average Working Capital. Interpretation of this ratio should be done when inter-firm or inter-period comparison is being done. It measures how efficiently a business turns its working capital into increase sales.

514405 -17219. A working capital turnover ratio of 6 indicates that the company is generating 6 for every 1 of working. 9 hours ago Working capital turnover ratio Net Sales Average working capital.

The working capital turnover ratio will be 1200000200000 6. In short the higher the working capital turnover ratio the better. Increasing ratio indicates that working capital is more active.

In order to use this. Where Net Sales Total Sales Returns. Activity ratios can be described as those financial matrices which determine the.

In this formula the working capital is calculated by subtracting a companys current liabilities from its current. Working capital turnover Net annual sales Working capital. Working capital turnover ratio is an important activity ratio in accounting theory and practice.

Working Capital Turnover Ratio Net Sales Average Working Capital. Net Working Capital Turnover Sales Net Current Assets 4 times. Where Net Sales Total Sales Sales Return.

9 Activity Ratios Analysis Ideas Analysis Financial Ratio Trend Analysis

Working Capital Turnover Ratio Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

Current Ratio Explained With Formula And Examples

Dr Marie Bani Khalid Dr Mari E Banikhaled Ppt Download

:max_bytes(150000):strip_icc()/Turnover-final-5caf76035a294523839d45114897ecac.png)

What Is Turnover In Business And Why Is It Important

Activity Ratio Formula And Calculator Step By Step

Ratio Analysis Classification Of Liquidity Ratio

Cost Management Accounting Unit No Iv Ratio Analysis Mba Ppt Download

Working Capital Turnover Ratio Formula Example And Interpretation

Ratio Analysis Class 12 Notes And Examples Accountancy Arinjay Academy

Important Questions For Cbse Class 12 Accountancy Classification Of Accounting Ratios

Working Capital Turnover Ratio Different Examples With Advantages

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Working Capital Turnover Ratio Formula Calculator Updated 2022

Financial Ratios Analysis Plan Projections

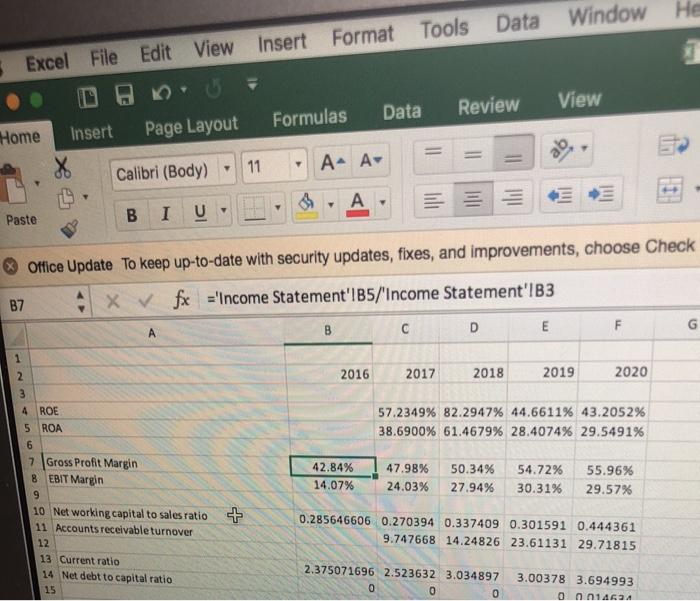

Solved Analysis The Net Working Capital To Sales Ratio And Chegg Com